Federal and State Business Income Tax Simplification with 2 or 1 Linear Formula

A. Federal Corporate Tax Simplification with the LG Tax Rate System (8 tax brackets are matched/reduced to 3 or 2)

B1. Existing and LG tax systems for Alaska corporations (10 tax brackets are matched/reduced to 2)

B2. Existing and LG tax systems for some state corporations with 1 fair and simple slope formula

B3. Existing and LG tax systems for Arkansas corporations (6 tax brackets are matched/reduced to 2)

A. Federal Corporate Tax Simplification with the LG Tax Rate System

There are 8 tax brackets with the tax rate ranging from 15% to 35% in our existing marginal tax system for corporations, which may be simplified to 3 or 2 tax brackets (50% or more reduction). USA and many countries use marginal tax systems multi tax brackets. More tax brackets mean more smooth tax rate changes, which are more reasonable for different taxable incomes, and involve more time and costs. Less tax brackets mean less smooth tax rate changes. A flat tax rate is too simple, which can not cover different taxable incomes reasonably and fairly. A nice business tax plan is to have relatively low bottom tax rate, which can encourage more people to start businesses. Small businesses hire many employees to meet social and economical needs for people and economical development. Then mid and large businesses are more stable and pay relatively higher tax rates. Two brackets for corporate tax calculation system are suggested.

Methods: We have done our tax simplification research with 12 publications at http://taxsimplecenter.net/publication.html (List). When 2 tax rates are set, simple effective (linear) tax rates between the two points with a straight line are fair and simple. Existing flat and curve or step tax rates with less or more tax brackets are unfair and complex. Figure 1 / Comparison

Our tax research goal is to match/simplify existing 3-10 tax brackets, 24-80 withholding formulas (with 8 filing periods) and (optional) xx-page Withholding Tables with 1 (or 2) fair and simple slope (linear) formulas and 1 existing formula to have more than 90% reduction. Also a checking tool is provided to reduce calculation mistakes. Then Withholding tax, income tax, tax return, analysis, reform and projection calculations can be simplified. Tax calculation simplification can be used to save time and costs. Effective tax rates are used to replace existing marginal tax rates simply. A flat tax rate is not suggested because it is too rough and unfair.

1. Existing Federal Tax Rate Schedule for Corporations

_______________________________________________________

Taxable income (TI) Tax Rate / Tax Computation

Over Not over

0 50,00 15%

50,000 - 75,000 7500 + 0.25 * (TI - 50000)

75,000 - 100,000 13750 + 0.34 * (TI - 75000)

100,000 - 335,000 22250 + 0.39 * (TI - 100000)

335,000 - 10 million 113900 + 0.34 * (TI - 335000)

10 x106 - 15 million 3400000 + 0.35 * (TI - 10000000)

15 x106 - 18,3333,333 5150000 + 0.38 * (TI - 15000000)

Over 18,333,333 35%

_______________________________________________________

2. LG Tax System for Federal Corporations (with range check)

________________________________________________________________________________

TI*F Yearly Taxable income TI Tax rate formula Tax rate Range check Tax

Over Not over

0 50,000 0.15 0.15

50,000 100,000 0.0775+TI*F/689,655 0.15-0.2225

100,000 335,000 0.39-16,750/TI/F 0.2225-0.34

335,000 0.35-3,350/TI/F 0.34-0.35

________________________________________________________________________________

Yearly taxable incomes (YTI) is TI*F. Filing period factor (F) is 52, 26, 24, 12, 4, 2 or 1 based on weekly (W), bi-weekly (2W), semi-monthly (SM), monthly (M), quarterly (Q), semi-yearly (SM) or yearly (Y), which is used for corporations to calculate withholding taxes.

The 8 tax brackets in Table 1 can be matched and reduced to 4 (50% reduction), which can be further simplified to 3 or 2 (below). One flat tax rate such as 21% or 25% is too simple and can not cover different incomes reasonably.

3. Discussion and comparison of the existing and LG tax systems

The taxable incomes of $50,000-75,000 and $75,000-100,000 in Table 1 may be combined together reasonably. A linear formula of y=a+bx can match these tax rates reasonably and simply. The tax rate is 34% at TI $335,000. There is only 1% difference from 34% to 35% for TI over $335,000, which can be covered by the simple formula 0.35–3,350/TI (tax rate range check: 0.34-0.35).

Tax rate differences from the existing corporate tax schedule (Table 1) and the LG tax system (Table 2) are shown in the following figure, which are comparable. The existing tax system shows the same tax rate at 34% and the LG tax system shows the different tax rates with gradual increase. It is a wide range from $335,000 to $10,000,000, which is about 30 times (10,000,000/335,000). The flat tax rate of 34% is not reasonable at taxable income of $335,000 or $10,000,000, which is from the formula ((113900+0.34(TI–335,000))/TI=34%) in Table 1.

(Taxable income: 1=$1,000, 2=$20,000, 3=$50,000, 4=$60,000, 5=$80,000, 6=$100,000, 7=$200,000, 8=$300,000, 9=$500,000, 10=$1,000,000, 11=$20,000,000)

One slope tax rate range can replace several existing tax brackets comparably. For existing tax system, more tax brackets mean more smooth tax rates. Linear slope is the most simple and reasonable without connecting with taxable incomes.

4. Tax Reform, Analysis and Projection

The 4 tax brackets in Table 2 can be further matched and simplified to 3 or 2 such as 15-35%, 15-25% or 15-28% practically.

Table 3. LG reform for Federal Corporations (3 tax brackets)

________________________________________________________________________________

Taxable Income TI*F Prior Tax Rates 15-35% Option A Tax Rates 15-25%

Over Not over Rate formula (Range check Rate formula (Range check)

0 100,000 TI*F/1,428,571.4+0.15 (0.15-0.22) TI*F/2,500,000+0.15 (0.15-0.19)

100,000 300,000 TI*F/1,754,386+0.09 (0.22-0.334) TI*F/5,000,000+0.17 (0.19-0.23)

300,000 0.35–4,800/TI/F (0.334-0.35) 0.25–6,000/TI/F (0.23-0.25)

________________________________________________________________________________

It is better to have a low bottom tax rate, which encourages people to start small companies, which can help small businesses to create more jobs.

Table 4. Two Corporate Tax Reform Options (2 tax brackets)

_______________________________________________________________________________

TI*F Option #1: Tax Rates 15-28% Option #2: Tax Rates 15-25%

Over Not over Rate formula (Range check) Rate formula (Range check)

0 120,000 TI*F/2,000,000+0.15 (0.15-0.21) TI*F/2,400,000+0.15 (0.15-0.2)

120,000* 0.28–8,400/TI/F (0.21-0.28) 0.25–6,000/TI/F (0.2-0.25)

_______________________________________________________________________________

Total Tax=0.15∑TIi+∑(TI2)i/2,400,000+0.25∑TIj-6,000 J (For 15-25%)

Withholding/Income Tax=(Incomes - Costs - (Deductions + Exemptions) ÷ F) × Tax rate - Tax credits ÷ F

When 2 (or 3) brackets are used with fixed taxable income ranges such as not over and over $120,000, lawmakers can concentrate to adjust tax rate (bottom/top) ranges to meet a tax goal or budget balance. Then tax rate formulas are decided easily. It is difficult to consider several factors with many options at the same time. The LG tax system provides the most reasonable, simple, smooth, and fair tax rates to adjust and meet its tax goal. Then "complex" political factors and options are converted into simple technical factors.

B. State Corporate Tax Simplification with the LG Tax Rate System State Corporate Tax Simplification

State corporate tax systems may be different from one flat tax rate to multiple tax brackets (from 1 to 10). A flat tax rate is too simple, making it difficult to cover different taxable incomes reasonably. Tax systems with more tax brackets (such as 5-10) are too complex, which take more time and cost more, for both corporations and governments. LG Tax System balances the two factors, using 2 or 3 tax brackets, providing a self-checking tool, and analyzing tax data easily for state tax systems, which make tax and tax rate calculations, analysis, modification and projection more reasonable and quick.

1. Existing and LG tax systems for Alaska corporations

Alaska has the most complex tax system in all US state corporate tax systems, having 10 tax brackets. Its tax rates for corporations are graduated from 1% to 9.4% in increments of $10,000 of taxable income. The maximum rate 9.4% applies to taxable income of $90,000 and over, which is shown in Table 1.

Table 1. Existing Alaska Corporate Tax Rates (10 tax brackets)

_______________________________________________________

Taxable Income (TI) Tax Computation

At Least But Less Than

-0- 10,000 0.01× TI

10,000 20,000 100+0.02× (TI-10,000)

20,000 30,000 300+0.03× (TI-20,000)

30,000 40,000 600+0.04× (TI-30,000)

40,000 50,000 1,000+0.05× (TI-40,000)

50,000 60,000 1,500+0.06× (TI-50,000)

60,000 70,000 2,100+0.07× (TI-60,000)

70,000 80,000 2,800+0.08× (TI-70,000)

80,000 90,000 3,600+0.09× (TI-80,000)

90,000 or More 4,500+0.094× (TI-90,000)

_______________________________________________________

When the LG Tax System is used, Alaska corporation tax can be matched and simplified (from Table 1 to Table 2) with 2 tax brackets and tax rate range checks. The tax rate differences between the existing and proposed LG Alaska corporate tax systems, which are shown in their figure, are very comparable, with a 0-0.001 difference. The original 10 tax brackets have been reduced to 2 with 80% reduction, which provides an easy tool for tax calculation, analysis, projection, and modification.

Table 2. LG Tax System for Alaska Corporations (2 brackets)

_________________________________________________________________________________________

TI*F Yearly Taxable Income TI Tax rate formula Tax rate Range check Tax

Over Not over

0 90,000 TI*F/2,250,00+0.01 0.01-0.05

90,000 0.094-3,960/TI/F 0.05-0.094

_________________________________________________________________________________________

Filing period factor (F) is 52, 26, 24, 12, 4, 2 or 1, which is based on weekly (W), bi-weekly (2W), semi-monthly (SM), monthly (M), quarterly (Q), semi-yearly (SM) or yearly (Y). TI*F is yearly taxable income (YTI).

Withholding/Income Tax=(Incomes - Costs - (Deductions + Exemptions) ÷ F) × Tax rate - Tax credits ÷ F

Tax analysis and projection

The following equation (1) is for the calculation of total tax with the LG tax system (Table 2). When the existing tax computations from Table 1 are used, total tax calculation is complex with a long equation (2).

Total Tax=0.01∑TIi+∑(TI2)i/2,250,000+0.094∑TIj-3,960 J = f(TI) ....... (1)

Total Tax=0.01∑TI1+∑(100+0.02(TI2-10,000))+∑(300+0.03(TI3-20,000))+∑(600+0.04(TI4-30,000))+∑(1,000+0.05(TI5-40,000))+ ∑(1,500+

0.06(TI6-50,000))+∑(2,100+0.07(TI7-60,000))+∑(2,800+0.08 (TI8-70,000))+∑(3,600+0.09(TI9-80,000))+∑(4,500+0.094(TI10-90,000)) ....... (2)

2. Existing and LG tax systems for some state corporations with 2-4 tax brackets

When an existing tax system with 5 or more tax brackets, smooth tax rates are reached, which can be matched and simplified with the LG tax system with 2 brackets. It is simple to use 2-4 tax brackets with an existing tax system. But their tax rates are rough, unreasonable and unfair. Also it means less tax to be collected relatively. When the LG tax simplification is used, tax rates are more smooth, reasonable and fair.

Existing KS and NE corporate tax rates have 2 tax brackets and IA has 4 tax brackets. KS tax rates are 4% at 0-$50,000 and 7% for above $50,000 with 2 tax brackets. At $120,000 (easy to divide 12), tax rate is 5.75%. When tax rates change smoothly, tax rates are reasonable. Table 1 shows smooth and reasonable tax rates. Their differences between existing and LG tax systems are shown in Figure 1 (attached). Then more taxes (maybe million $) will be collected reasonably and fairly. 4%-7% may be reduced from 4%-7% to 3.5%-7% to have neutral tax revenue and encourage more people to start businesses at starting tax rate at 3.5% (Table 2). 3.5% is less than MO corporate tax rate 4% (from 6.25%).

KS needs tax reforms with smooth tax rate changes and less tax brackets and formulas as possible. KS Tax Simplification

-Existing corporate 4%-7% are modified to 3% (or 3.5%)-5.5%-7% smoothly with neutral revenue (3% is more competitive): Solution (No. 4)

Table 1 LG Tax System for KS corporations (2 tax brackets)

____________________________________________________________________________________

TI*F Yearly Taxable income TI Tax rate formula Tax rate Range check Tax

Over Not over (Rate*TI)

0 120,000 0.04+TI*F/6,857,143 0.04-0.0575

120,000 0.07-1,500/TI/F 0.0575-0.07

____________________________________________________________________________________

Total tax = 0.04SumTIa + Sum(TIa)2/6,857,143 + 0.07 SumTIb-1,500 B

Table 2 Modified LG Tax System for KS corporations (2 tax brackets)

____________________________________________________________________________________

TI*F Yearly Taxable income TI Tax rate formula Tax rate Range check Tax

Over Not over (Rate*TI)

0 120,000 (TI*F/C + B) TI 0.035-0.0575

120,000 (T - D/TI/F) TI 0.0575-0.07

____________________________________________________________________________________

Option #1: C=120,000/(0.0575-B)=5,333,333 with bottom tax rate (B) 0.035 and D=120,000*(T-0.0575)=1,500 with top tax rate (T) 0.07.

Total tax = 0.035SumTIa + Sum(TIa)2/5,000,000 + 0.07 SumTIb-1,500 B

Option #2: C=120,000/(0.05-B)=6,000,000 with bottom tax rate (B) 0.03 and D=120,000*(T-0.05)=1,800 with top tax rate (T) 0.065.

LG tax simplification for some state corporations with 2-4 tax brackets: State Corporate Tax Simplification

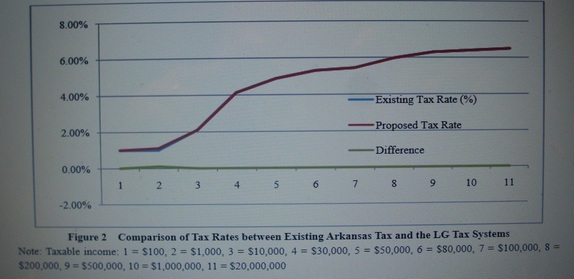

3. Existing and LG tax systems for Arkansas corporations

Existing Arkansas corporate tax rates are graduated rates applied to the Arkansas Net Taxable Income (NTI), which are shown in Table 1. The tax computations are complex when taxable incomes are not over $25,000. Their tax rates range from 1% to 6.5% with 6 brackets. Existing Arkansas tax system is relatively complex in US state corporate tax systems.

Table 1 Existing Arkansas Tax System for Corporations (6 tax brackets)

__________________________________________________________________________

Taxable Income (TI) Tax Computation

Over Not over

0 3,000 0.01×TI

3,000 6,000 0.01×3,000+0.02× (TI-3,000)

6,000 11,000 0.01×3,000+0.02×3,000+0.03× (TI-6,000)

11,000 25,000 0.01×3,000+0.02×3,000+0.03×5,000+0.05× (T-11,000)

25,000 100,000 940+0.06× (TI-25,000)

100,000 5,440+0.065× (TI-100,000)

__________________________________________________________________________

The existing Corporation Income Tax Table (2 pages) for taxable incomes from $100 to $25,000 is provided. When the LG tax system is used, the above 6 tax brackets are reduced to 3, which is shown in Table 2. A tax rate range check is used as a tool to check tax rate and tax calculations. The lesser amount of tax brackets provide an easy tool for tax calculation, analysis and projection reasonably and simply.

When a LG tax rate formula is used to match the tax rates from taxable income ranges from 0 to $25,000, a linear relationship of y=a+bx is found:

Tax rate = 0.01 + TI / 905,797 (tax rate range: 0.01-0.0376)

Here 1/905,797, which is the slope for y = a + bx, is derived from 1/25000/(0.0376-0.01) = 905,797. The value 0.0376 is from the original tax computation in tax rate format [30+60+150+0.05*(25,000-11,000)]/25,000= 0.0376.

Table 2 LG Tax System for Arkansas corporations (3 tax brackets)

____________________________________________________________________________________

TI*F TI*F range TI Tax rate formula Tax rate Range check Tax

Over Not over

0 25,000 TI*F/905,797+0.01 0.01-0.0376

25,000 100,000 0.06-560/TI/F 0.0376-0.0544

100,000 0.065-1,060/TI/F 0.0544-0.065

____________________________________________________________________________________

Filing period factor (F) is 52, 26, 24, 12, 4, 2 or 1 based on weekly (W), bi-weekly (2W), semi-monthly (SM), monthly (M), quarterly (Q), semi-yearly (SM) or yearly (Y) is used for employers to calculate tax withholding. TI*F is yearly taxable income (YTI).

For TI over $25,000, the tax computation is converted into tax rate:

Tax = 940+0.06 (TI-25,000)=0.06TI-560 or Tax rate=0.06-560/TI

For TI over $100,000, the tax computation is converted into tax rate:

Tax=5,440+0.065 (TI-100,000)=0.065TI-1,060 or Tax rate = 0.065-1,060/TI

The tax rate differences between the existing Arkansas and LG tax systems are almost the same for TI from $100 to $20,000,000, which are very comparable and shown with the following figure. Total tax is a function of TI.

Total Tax= 0.01∑TIt + ∑(TI2)t/905,797+0.06∑TIu-560 u+0.065∑TIv-1,060 v

Here t, u, and v are corporation numbers during the three taxable income ranges. The total tax equation may be used for total tax calculation, projection and analysis. During a recession, booming economy or special situation, LG tax rates may be modified or reformed simply.

Table 2 (3 tax rate ranges) can be further simplified to Table 5 (2 tax rate ranges). Taxable income range is divided at $60,000/year (or $5,000/month).

Table 3 LG Tax System for Arkansas corporations (2 tax brackets)

____________________________________________________________________________________

TI*F Yearly Taxable income TI Tax rate formula Tax rate Range check Tax

Over Not over (Rate*TI)

0 60,000 (TI*F/C + B) TI 0.01-0.0507

60,000 (T - D/TI/F) TI 0.0507-0.065

____________________________________________________________________________________

C=60,000/(0.0507-B)= 1,474,201 with bottom tax rate (B) 0.01 and D=60,000*(T-0.0507)=858 with top tax rate (T) 0.065.

Total Tax= 0.01∑TIa+ ∑(TI2)a/1,474,201.5+0.065∑TIb-858 B

Withholding/Income Tax=(Incomes - Costs - (Deductions + Exemptions) ÷ F) × Tax rate - Tax credits ÷ F

B1. Existing and LG tax systems for Alaska corporations (10 tax brackets are matched/reduced to 2)

B2. Existing and LG tax systems for some state corporations with 1 fair and simple slope formula

B3. Existing and LG tax systems for Arkansas corporations (6 tax brackets are matched/reduced to 2)

A. Federal Corporate Tax Simplification with the LG Tax Rate System

There are 8 tax brackets with the tax rate ranging from 15% to 35% in our existing marginal tax system for corporations, which may be simplified to 3 or 2 tax brackets (50% or more reduction). USA and many countries use marginal tax systems multi tax brackets. More tax brackets mean more smooth tax rate changes, which are more reasonable for different taxable incomes, and involve more time and costs. Less tax brackets mean less smooth tax rate changes. A flat tax rate is too simple, which can not cover different taxable incomes reasonably and fairly. A nice business tax plan is to have relatively low bottom tax rate, which can encourage more people to start businesses. Small businesses hire many employees to meet social and economical needs for people and economical development. Then mid and large businesses are more stable and pay relatively higher tax rates. Two brackets for corporate tax calculation system are suggested.

Methods: We have done our tax simplification research with 12 publications at http://taxsimplecenter.net/publication.html (List). When 2 tax rates are set, simple effective (linear) tax rates between the two points with a straight line are fair and simple. Existing flat and curve or step tax rates with less or more tax brackets are unfair and complex. Figure 1 / Comparison

Our tax research goal is to match/simplify existing 3-10 tax brackets, 24-80 withholding formulas (with 8 filing periods) and (optional) xx-page Withholding Tables with 1 (or 2) fair and simple slope (linear) formulas and 1 existing formula to have more than 90% reduction. Also a checking tool is provided to reduce calculation mistakes. Then Withholding tax, income tax, tax return, analysis, reform and projection calculations can be simplified. Tax calculation simplification can be used to save time and costs. Effective tax rates are used to replace existing marginal tax rates simply. A flat tax rate is not suggested because it is too rough and unfair.

1. Existing Federal Tax Rate Schedule for Corporations

_______________________________________________________

Taxable income (TI) Tax Rate / Tax Computation

Over Not over

0 50,00 15%

50,000 - 75,000 7500 + 0.25 * (TI - 50000)

75,000 - 100,000 13750 + 0.34 * (TI - 75000)

100,000 - 335,000 22250 + 0.39 * (TI - 100000)

335,000 - 10 million 113900 + 0.34 * (TI - 335000)

10 x106 - 15 million 3400000 + 0.35 * (TI - 10000000)

15 x106 - 18,3333,333 5150000 + 0.38 * (TI - 15000000)

Over 18,333,333 35%

_______________________________________________________

2. LG Tax System for Federal Corporations (with range check)

________________________________________________________________________________

TI*F Yearly Taxable income TI Tax rate formula Tax rate Range check Tax

Over Not over

0 50,000 0.15 0.15

50,000 100,000 0.0775+TI*F/689,655 0.15-0.2225

100,000 335,000 0.39-16,750/TI/F 0.2225-0.34

335,000 0.35-3,350/TI/F 0.34-0.35

________________________________________________________________________________

Yearly taxable incomes (YTI) is TI*F. Filing period factor (F) is 52, 26, 24, 12, 4, 2 or 1 based on weekly (W), bi-weekly (2W), semi-monthly (SM), monthly (M), quarterly (Q), semi-yearly (SM) or yearly (Y), which is used for corporations to calculate withholding taxes.

The 8 tax brackets in Table 1 can be matched and reduced to 4 (50% reduction), which can be further simplified to 3 or 2 (below). One flat tax rate such as 21% or 25% is too simple and can not cover different incomes reasonably.

3. Discussion and comparison of the existing and LG tax systems

The taxable incomes of $50,000-75,000 and $75,000-100,000 in Table 1 may be combined together reasonably. A linear formula of y=a+bx can match these tax rates reasonably and simply. The tax rate is 34% at TI $335,000. There is only 1% difference from 34% to 35% for TI over $335,000, which can be covered by the simple formula 0.35–3,350/TI (tax rate range check: 0.34-0.35).

Tax rate differences from the existing corporate tax schedule (Table 1) and the LG tax system (Table 2) are shown in the following figure, which are comparable. The existing tax system shows the same tax rate at 34% and the LG tax system shows the different tax rates with gradual increase. It is a wide range from $335,000 to $10,000,000, which is about 30 times (10,000,000/335,000). The flat tax rate of 34% is not reasonable at taxable income of $335,000 or $10,000,000, which is from the formula ((113900+0.34(TI–335,000))/TI=34%) in Table 1.

(Taxable income: 1=$1,000, 2=$20,000, 3=$50,000, 4=$60,000, 5=$80,000, 6=$100,000, 7=$200,000, 8=$300,000, 9=$500,000, 10=$1,000,000, 11=$20,000,000)

One slope tax rate range can replace several existing tax brackets comparably. For existing tax system, more tax brackets mean more smooth tax rates. Linear slope is the most simple and reasonable without connecting with taxable incomes.

4. Tax Reform, Analysis and Projection

The 4 tax brackets in Table 2 can be further matched and simplified to 3 or 2 such as 15-35%, 15-25% or 15-28% practically.

Table 3. LG reform for Federal Corporations (3 tax brackets)

________________________________________________________________________________

Taxable Income TI*F Prior Tax Rates 15-35% Option A Tax Rates 15-25%

Over Not over Rate formula (Range check Rate formula (Range check)

0 100,000 TI*F/1,428,571.4+0.15 (0.15-0.22) TI*F/2,500,000+0.15 (0.15-0.19)

100,000 300,000 TI*F/1,754,386+0.09 (0.22-0.334) TI*F/5,000,000+0.17 (0.19-0.23)

300,000 0.35–4,800/TI/F (0.334-0.35) 0.25–6,000/TI/F (0.23-0.25)

________________________________________________________________________________

It is better to have a low bottom tax rate, which encourages people to start small companies, which can help small businesses to create more jobs.

Table 4. Two Corporate Tax Reform Options (2 tax brackets)

_______________________________________________________________________________

TI*F Option #1: Tax Rates 15-28% Option #2: Tax Rates 15-25%

Over Not over Rate formula (Range check) Rate formula (Range check)

0 120,000 TI*F/2,000,000+0.15 (0.15-0.21) TI*F/2,400,000+0.15 (0.15-0.2)

120,000* 0.28–8,400/TI/F (0.21-0.28) 0.25–6,000/TI/F (0.2-0.25)

_______________________________________________________________________________

Total Tax=0.15∑TIi+∑(TI2)i/2,400,000+0.25∑TIj-6,000 J (For 15-25%)

Withholding/Income Tax=(Incomes - Costs - (Deductions + Exemptions) ÷ F) × Tax rate - Tax credits ÷ F

When 2 (or 3) brackets are used with fixed taxable income ranges such as not over and over $120,000, lawmakers can concentrate to adjust tax rate (bottom/top) ranges to meet a tax goal or budget balance. Then tax rate formulas are decided easily. It is difficult to consider several factors with many options at the same time. The LG tax system provides the most reasonable, simple, smooth, and fair tax rates to adjust and meet its tax goal. Then "complex" political factors and options are converted into simple technical factors.

B. State Corporate Tax Simplification with the LG Tax Rate System State Corporate Tax Simplification

State corporate tax systems may be different from one flat tax rate to multiple tax brackets (from 1 to 10). A flat tax rate is too simple, making it difficult to cover different taxable incomes reasonably. Tax systems with more tax brackets (such as 5-10) are too complex, which take more time and cost more, for both corporations and governments. LG Tax System balances the two factors, using 2 or 3 tax brackets, providing a self-checking tool, and analyzing tax data easily for state tax systems, which make tax and tax rate calculations, analysis, modification and projection more reasonable and quick.

1. Existing and LG tax systems for Alaska corporations

Alaska has the most complex tax system in all US state corporate tax systems, having 10 tax brackets. Its tax rates for corporations are graduated from 1% to 9.4% in increments of $10,000 of taxable income. The maximum rate 9.4% applies to taxable income of $90,000 and over, which is shown in Table 1.

Table 1. Existing Alaska Corporate Tax Rates (10 tax brackets)

_______________________________________________________

Taxable Income (TI) Tax Computation

At Least But Less Than

-0- 10,000 0.01× TI

10,000 20,000 100+0.02× (TI-10,000)

20,000 30,000 300+0.03× (TI-20,000)

30,000 40,000 600+0.04× (TI-30,000)

40,000 50,000 1,000+0.05× (TI-40,000)

50,000 60,000 1,500+0.06× (TI-50,000)

60,000 70,000 2,100+0.07× (TI-60,000)

70,000 80,000 2,800+0.08× (TI-70,000)

80,000 90,000 3,600+0.09× (TI-80,000)

90,000 or More 4,500+0.094× (TI-90,000)

_______________________________________________________

When the LG Tax System is used, Alaska corporation tax can be matched and simplified (from Table 1 to Table 2) with 2 tax brackets and tax rate range checks. The tax rate differences between the existing and proposed LG Alaska corporate tax systems, which are shown in their figure, are very comparable, with a 0-0.001 difference. The original 10 tax brackets have been reduced to 2 with 80% reduction, which provides an easy tool for tax calculation, analysis, projection, and modification.

Table 2. LG Tax System for Alaska Corporations (2 brackets)

_________________________________________________________________________________________

TI*F Yearly Taxable Income TI Tax rate formula Tax rate Range check Tax

Over Not over

0 90,000 TI*F/2,250,00+0.01 0.01-0.05

90,000 0.094-3,960/TI/F 0.05-0.094

_________________________________________________________________________________________

Filing period factor (F) is 52, 26, 24, 12, 4, 2 or 1, which is based on weekly (W), bi-weekly (2W), semi-monthly (SM), monthly (M), quarterly (Q), semi-yearly (SM) or yearly (Y). TI*F is yearly taxable income (YTI).

Withholding/Income Tax=(Incomes - Costs - (Deductions + Exemptions) ÷ F) × Tax rate - Tax credits ÷ F

Tax analysis and projection

The following equation (1) is for the calculation of total tax with the LG tax system (Table 2). When the existing tax computations from Table 1 are used, total tax calculation is complex with a long equation (2).

Total Tax=0.01∑TIi+∑(TI2)i/2,250,000+0.094∑TIj-3,960 J = f(TI) ....... (1)

Total Tax=0.01∑TI1+∑(100+0.02(TI2-10,000))+∑(300+0.03(TI3-20,000))+∑(600+0.04(TI4-30,000))+∑(1,000+0.05(TI5-40,000))+ ∑(1,500+

0.06(TI6-50,000))+∑(2,100+0.07(TI7-60,000))+∑(2,800+0.08 (TI8-70,000))+∑(3,600+0.09(TI9-80,000))+∑(4,500+0.094(TI10-90,000)) ....... (2)

2. Existing and LG tax systems for some state corporations with 2-4 tax brackets

When an existing tax system with 5 or more tax brackets, smooth tax rates are reached, which can be matched and simplified with the LG tax system with 2 brackets. It is simple to use 2-4 tax brackets with an existing tax system. But their tax rates are rough, unreasonable and unfair. Also it means less tax to be collected relatively. When the LG tax simplification is used, tax rates are more smooth, reasonable and fair.

Existing KS and NE corporate tax rates have 2 tax brackets and IA has 4 tax brackets. KS tax rates are 4% at 0-$50,000 and 7% for above $50,000 with 2 tax brackets. At $120,000 (easy to divide 12), tax rate is 5.75%. When tax rates change smoothly, tax rates are reasonable. Table 1 shows smooth and reasonable tax rates. Their differences between existing and LG tax systems are shown in Figure 1 (attached). Then more taxes (maybe million $) will be collected reasonably and fairly. 4%-7% may be reduced from 4%-7% to 3.5%-7% to have neutral tax revenue and encourage more people to start businesses at starting tax rate at 3.5% (Table 2). 3.5% is less than MO corporate tax rate 4% (from 6.25%).

KS needs tax reforms with smooth tax rate changes and less tax brackets and formulas as possible. KS Tax Simplification

-Existing corporate 4%-7% are modified to 3% (or 3.5%)-5.5%-7% smoothly with neutral revenue (3% is more competitive): Solution (No. 4)

Table 1 LG Tax System for KS corporations (2 tax brackets)

____________________________________________________________________________________

TI*F Yearly Taxable income TI Tax rate formula Tax rate Range check Tax

Over Not over (Rate*TI)

0 120,000 0.04+TI*F/6,857,143 0.04-0.0575

120,000 0.07-1,500/TI/F 0.0575-0.07

____________________________________________________________________________________

Total tax = 0.04SumTIa + Sum(TIa)2/6,857,143 + 0.07 SumTIb-1,500 B

Table 2 Modified LG Tax System for KS corporations (2 tax brackets)

____________________________________________________________________________________

TI*F Yearly Taxable income TI Tax rate formula Tax rate Range check Tax

Over Not over (Rate*TI)

0 120,000 (TI*F/C + B) TI 0.035-0.0575

120,000 (T - D/TI/F) TI 0.0575-0.07

____________________________________________________________________________________

Option #1: C=120,000/(0.0575-B)=5,333,333 with bottom tax rate (B) 0.035 and D=120,000*(T-0.0575)=1,500 with top tax rate (T) 0.07.

Total tax = 0.035SumTIa + Sum(TIa)2/5,000,000 + 0.07 SumTIb-1,500 B

Option #2: C=120,000/(0.05-B)=6,000,000 with bottom tax rate (B) 0.03 and D=120,000*(T-0.05)=1,800 with top tax rate (T) 0.065.

LG tax simplification for some state corporations with 2-4 tax brackets: State Corporate Tax Simplification

3. Existing and LG tax systems for Arkansas corporations

Existing Arkansas corporate tax rates are graduated rates applied to the Arkansas Net Taxable Income (NTI), which are shown in Table 1. The tax computations are complex when taxable incomes are not over $25,000. Their tax rates range from 1% to 6.5% with 6 brackets. Existing Arkansas tax system is relatively complex in US state corporate tax systems.

Table 1 Existing Arkansas Tax System for Corporations (6 tax brackets)

__________________________________________________________________________

Taxable Income (TI) Tax Computation

Over Not over

0 3,000 0.01×TI

3,000 6,000 0.01×3,000+0.02× (TI-3,000)

6,000 11,000 0.01×3,000+0.02×3,000+0.03× (TI-6,000)

11,000 25,000 0.01×3,000+0.02×3,000+0.03×5,000+0.05× (T-11,000)

25,000 100,000 940+0.06× (TI-25,000)

100,000 5,440+0.065× (TI-100,000)

__________________________________________________________________________

The existing Corporation Income Tax Table (2 pages) for taxable incomes from $100 to $25,000 is provided. When the LG tax system is used, the above 6 tax brackets are reduced to 3, which is shown in Table 2. A tax rate range check is used as a tool to check tax rate and tax calculations. The lesser amount of tax brackets provide an easy tool for tax calculation, analysis and projection reasonably and simply.

When a LG tax rate formula is used to match the tax rates from taxable income ranges from 0 to $25,000, a linear relationship of y=a+bx is found:

Tax rate = 0.01 + TI / 905,797 (tax rate range: 0.01-0.0376)

Here 1/905,797, which is the slope for y = a + bx, is derived from 1/25000/(0.0376-0.01) = 905,797. The value 0.0376 is from the original tax computation in tax rate format [30+60+150+0.05*(25,000-11,000)]/25,000= 0.0376.

Table 2 LG Tax System for Arkansas corporations (3 tax brackets)

____________________________________________________________________________________

TI*F TI*F range TI Tax rate formula Tax rate Range check Tax

Over Not over

0 25,000 TI*F/905,797+0.01 0.01-0.0376

25,000 100,000 0.06-560/TI/F 0.0376-0.0544

100,000 0.065-1,060/TI/F 0.0544-0.065

____________________________________________________________________________________

Filing period factor (F) is 52, 26, 24, 12, 4, 2 or 1 based on weekly (W), bi-weekly (2W), semi-monthly (SM), monthly (M), quarterly (Q), semi-yearly (SM) or yearly (Y) is used for employers to calculate tax withholding. TI*F is yearly taxable income (YTI).

For TI over $25,000, the tax computation is converted into tax rate:

Tax = 940+0.06 (TI-25,000)=0.06TI-560 or Tax rate=0.06-560/TI

For TI over $100,000, the tax computation is converted into tax rate:

Tax=5,440+0.065 (TI-100,000)=0.065TI-1,060 or Tax rate = 0.065-1,060/TI

The tax rate differences between the existing Arkansas and LG tax systems are almost the same for TI from $100 to $20,000,000, which are very comparable and shown with the following figure. Total tax is a function of TI.

Total Tax= 0.01∑TIt + ∑(TI2)t/905,797+0.06∑TIu-560 u+0.065∑TIv-1,060 v

Here t, u, and v are corporation numbers during the three taxable income ranges. The total tax equation may be used for total tax calculation, projection and analysis. During a recession, booming economy or special situation, LG tax rates may be modified or reformed simply.

Table 2 (3 tax rate ranges) can be further simplified to Table 5 (2 tax rate ranges). Taxable income range is divided at $60,000/year (or $5,000/month).

Table 3 LG Tax System for Arkansas corporations (2 tax brackets)

____________________________________________________________________________________

TI*F Yearly Taxable income TI Tax rate formula Tax rate Range check Tax

Over Not over (Rate*TI)

0 60,000 (TI*F/C + B) TI 0.01-0.0507

60,000 (T - D/TI/F) TI 0.0507-0.065

____________________________________________________________________________________

C=60,000/(0.0507-B)= 1,474,201 with bottom tax rate (B) 0.01 and D=60,000*(T-0.0507)=858 with top tax rate (T) 0.065.

Total Tax= 0.01∑TIa+ ∑(TI2)a/1,474,201.5+0.065∑TIb-858 B

Withholding/Income Tax=(Incomes - Costs - (Deductions + Exemptions) ÷ F) × Tax rate - Tax credits ÷ F